The Discount rate in NI has not been changed since 2001. Unlike in England & Wales and Scotland, where the methodology for revision of the rate has changed to take into consideration a more realistic approach, the 1996 Act provides for a considerably lower risk approach.

Northern Ireland’s Justice Minister has announced that she has asked officials to undertake a statutory consultation to consider the discount rate in Northern Ireland (NI). The consultation, which is required under the Damages Act 1996, will be conducted with the Government Actuary’s Department and the Department of Finance. They will consider a proposed change from 2.5% to minus 1.75%.

The Discount rate in NI has not been changed since 2001. Unlike in England & Wales and Scotland, where the methodology for revision of the rate has changed to take into consideration a more realistic approach, the 1996 Act provides for a considerably lower risk approach.

In her letter, the Minister has left the door open to the possibility of changing the approach for this review and has confirmed that she will comment in due course. With the backlog in Legislation in Stormont, there is likely to be sufficient time for a change in Legislation if the industry can influence a change in approach to reflect the changes already made in the rest of the UK.

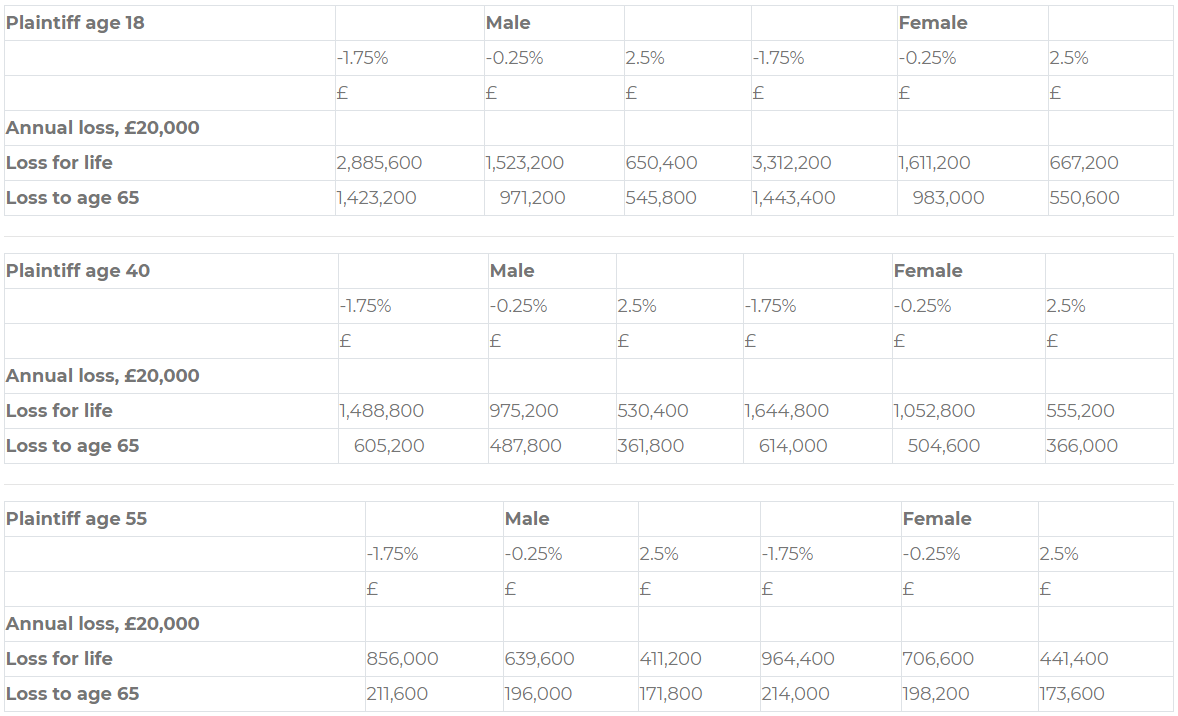

At present the Ogden Tables do not include multipliers at a discount rate of -1.75%. Therefore, we have discussed the matter with ASM Forensic Accountants and set out, for illustrative purposes only, the potential implications of the proposed rate change:

These figures are based on a projected “normal” life expectancy as per the Ogden Tables.

As the discount rate employed will be that at the date of trial, rather than date of accident, the impact of such a change will require substantial reserve re-calculations. The potential increase in the cost of claims may put off insurers writing policies in NI, which in turn could have the unintended consequence of increased premiums for all motorists.

Whilst we all want to ensure that those injured are fairly and appropriately compensated, we fear that the proposed rate may ultimately lead to pricing some consumers out of purchasing motor insurance, shifting the burden to those who have paid their premium.

Matthew Fitzpatrick, Head of Horwich Farrelly NI, and Malcolm Henke, Head of Horwich Farrelly’s Large and Catastrophic Injury Group will be consulting with clients and are committed to ensuring that the industry viewpoint on the impact of the proposed rate change is heard.

Matthew and Malcolm will be working with the Association of British Insurers, who are providing guidance to the Minister on the practical implications for not just high value personal injury claims but also for insurers who are writing policies in Northern Ireland. We would therefore welcome your views on the proposal, particularly your thoughts on what we believe the key impacts will be:

- Significant increases in reserves

- Increased insurance premiums

- Increased reinsurance costs

- Reduction in availability of motor / liability insurance

- Increase in uninsured accidents

Please note that it is imperative that your views are heard at this critical time and therefore we would ask that you contact Matthew or Malcolm to discuss further.

You may also like

Essential reading for any insurer writing policies in Northern Ireland

After significant delay, the sixth edition of the JSB guidelines (Green Book) in Northern Ireland has finally arrived. Matthew Fitzpatrick,...

HF Invests In A Second Belfast Office As Team Continues To Grow

Our fast-growing team will expand into the ultra-modern office space in the Lincoln Building, Victoria Street. The office is close...

Update to Ireland’s Occupiers’ Liability Law

For almost 30 years, the Occupiers’ Liability Act, 1995 (“the 1995 Act”) has represented the settled statutory position in Ireland...

Matt Fitzpatrick featured in The Irish News High Flyers

Matthew Fitzpatrick was recently featured in The Irish News, sharing some interesting facts about himself and his background in their...