Questions are now being asked as to how far we are from implementing the technology, infrastructure and regulatory framework required to make full self-driving a reality.

After a flurry of activity in 2022, the march towards fully automated self-driving seems to have stalled somewhat in 2023. Last year, there was much excitement for the future of self-driving, touted to bring with it improved vehicle safety and reduced traffic and emissions. But questions are now being asked as to how far we are from implementing the technology, infrastructure and regulatory framework required to make full self-driving a reality. And there has been a subtle shift in opinion against automated vehicle technologies being implemented before they and we are ready.

But whilst full self-driving may be further away than we had envisaged only last year, manufacturers continue to develop advanced driver-assistance systems (ADAS) and other advanced automated features (falling just short of SAE Level 3; the point at which a driver can relinquish responsibility). And at HF, we are starting to see the impact of these developments on motor claims. That includes a noticeable increase in policyholders blaming the technology in their vehicles for causing accidents. And it also includes an increase in battles with manufacturers for control of the comprehensive data which is stored in vehicles but is being jealously guarded by vehicle manufacturers.

Against this backdrop, we look at the state of automated vehicle technology, the ways in which it is being developed (or not developed) and the benefits and challenges already being faced by insurers.

Has the road to full self-driving been closed for now?

In 2022, rapid progress was made towards the regulation of self-driving. In January, the Law Commission published its joint report on automated vehicles (AVs). Then in May, the Queen’s Speech heralded the introduction of the Transport Bill (to address AVs and e-scooters among other things). The Transport Committee launched an inquiry seeking input on the development and deployment of self-driving vehicles. The government published a policy paper, welcoming the Law Commission’s recommendations and initiated a new consultation on creating a new legal and safety framework for self-driving vehicles. A new Automated Vehicles Act was announced.

In this context, the implementation of SAE Level 3 technology, like automated lane keeping systems (ALKS), felt like it was just around the corner.

But elsewhere we of course had two changes of prime ministers (from Boris to Liz in September; and from Liz to Rishi in October) who brought with them changing priorities, including a focus on the ‘cost of living crisis’. Then in October, the government announced it would not bring forward the Transport Bill in the current parliamentary session. There was some suggestion we might see a smaller version of the Transport Bill, but with no sign of that appearing yet.

This has led to many in the industry to call on the government to bring forward its proposals for AV legislation or risk falling behind the rest of the world.

The technology and its limits

Recent reports have demonstrated a level of uncertainty and confusion in the general public as to the state of self-driving technology, with a large number of people believing full self-driving vehicles have already been developed and are available to purchase.

In fact, there are only a few vehicles available in the world that can satisfy even SAE Level 3 – meaning the vehicle can drive itself under very limited conditions. That includes the Mercedes-Benz S-Class and EQS which both come with ‘Drive Pilot’ (a version of ALKS) which can be purchased and used in Germany only (with Nevada to follow later this year).

In the meantime, there has been a steady chipping away at the confidence previously placed in self-driving technology, along with a recognition that human drivers are not so terrible after all, causing roughly 1 death per 200 million miles – which is perhaps a high bar for self-driving to overcome.

A run of bad press for Tesla hasn’t helped. In September, US-based Tesla owners launched a class-action alleging that the company falsely advertises its technology as self-driving. (Tesla sells a feature it calls ‘Full Self-Driving’, which is in fact only SAE Level 2.) In December, California banned manufacturers like Tesla from marketing their advanced automated features as fully self-driving. In February, the Dawn Project ran an anti-Tesla advert during the US Super Bowl which showed Tesla vehicles failing to stop for child-sized test dummies.

Elsewhere, there have been reports of many self-driving start-ups plummeting in value and being bought out or simply going out of business. For example, in late 2022 it was announced that Ford and VW were pulling out of Argo AI, perhaps in recognition that full self-driving (along with any financial returns) is further away than previously anticipated.

In addition, the narrative is perhaps being reframed, with manufacturers no longer working towards privately owned AVs but instead focusing on fleet applications, like robo-taxis and autonomous delivery vehicles. The industry may ultimately adopt a sharing economy model and move away from vehicle ownership.

In the meantime, manufacturers continue to offer more advanced driver features, which fall just short of Level 3 but offer automation without taking away the driver’s responsibilities. This is often referred to Level 2+, followed by Level 2++, etc.

What this means for insurers

As manufacturers add more advanced automated features, the overall safety of vehicles should (on average) improve. For this reason, many insurers welcome these new technologies – but also face problems in keeping track of which technologies are supplied as standard in each vehicle model (and whether the driver is using the features or not). This, together with the high costs of repair, has made it difficult for insurers to reduce premiums to reflect the safety gains.

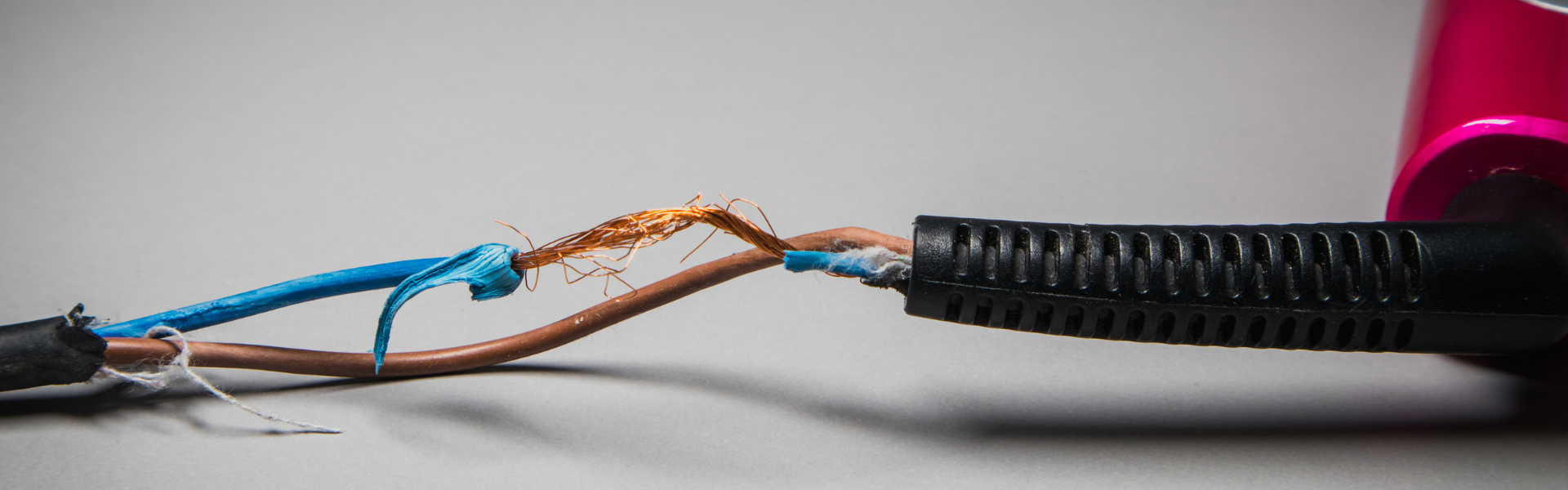

In addition, adding more advanced automated features to vehicles, but without taking responsibility away from the driver, creates much more scope for conflict between drivers and manufacturers, as the line between the functions of the driver and vehicle blurs. This has led to a noticeable increase in policyholders blaming their vehicles for causing accidents (whether their arguments have merit or not).

For example, in January The Times reported that a BMW X5, equipped with ‘speed limit assist’, had taken over from the driver and accelerated on its own, having registered the speed limit as 110mph. (There was a suggestion the vehicle’s sensors had picked up writing or numbers on the side of the road.) HF are dealing with several claims involving similar allegations by policyholders.

We are also seeing an increasing number of claims where data is an issue. As the sophistication of vehicle technology increases, so too does the data available – and in most claims this data will be invaluable to the insurer since it provides far greater insight into collisions than ever before. At the very least, it will reveal details about driver inputs (pedals, steering, speed, etc.) and, in some cases, may confirm whether there was a vehicle fault.

But our experience at HF is that manufacturers are very reluctant to assist in the retrieval of this data, which will often need to be downloaded using specialist tools and interpreted using bespoke software, only available to the manufacturer. Of course, in the right case (where the cost is justified), the CPR and its rules on disclosure may assist insurers in forcing disclosure.

Against this backdrop, we at HF see an opportunity for insurers to steel a march on manufacturers (and competitors) by fully taking stock of the technologies available, their potential impact on claims and the opportunities for recoveries. Advanced automated features have the potential to cause accidents including where the technology fails or where the interface is not well designed – or even where users are not adequately trained. And Insurers will not want to miss out on recovery opportunities and will want to be well positioned to deal with such claims (including how to get hold of the data) as they become more prevalent.

If you would like to discuss any of the issues arising from both self-driving and advanced automated features and the impact on motor claims, please do get in touch with Daniel West, Head of Product Liability at HF.

You may also like

Product Liability Bitesize – December Edition

When we first started producing these quarterly updates covering all things product liability (check our earlier editions), we wondered whether...

Product Liability Post-Brexit Update

We’re now nearly two years from when the transition period under the EU-UK Withdrawal Agreement came to an end, but...

Product Liability Bitesize – September Edition

It’s been a busy time since the first edition of our regular product liability update. The Queen’s Speech heralded new laws...

An update on autonomous vehicles

UK Government accepts the Law Commission’s recommendations on AVs On 19/08/22 the government published its policy paper, ‘Connected and automated...